Someone is sitting in the shade today because someone planted a tree a long time ago.

– Warren Buffett

Our donors may now craft a meaningful legacy at the Marion Institute through planned gifts, impacting our mission in perpetuity.

The Marion Institute works to inspire and connect people of diverse backgrounds with the common goal of fostering positive social change. Without your support, this most essential work cannot be done! Thank you for your support.

The Marion Institute is a 501(c)3 organization. All donations are tax-deductible.

The Rule of 20: A Simple Way to Create a Lasting Legacy

The Rule of 20: A Simple Way to Create a Lasting Legacy

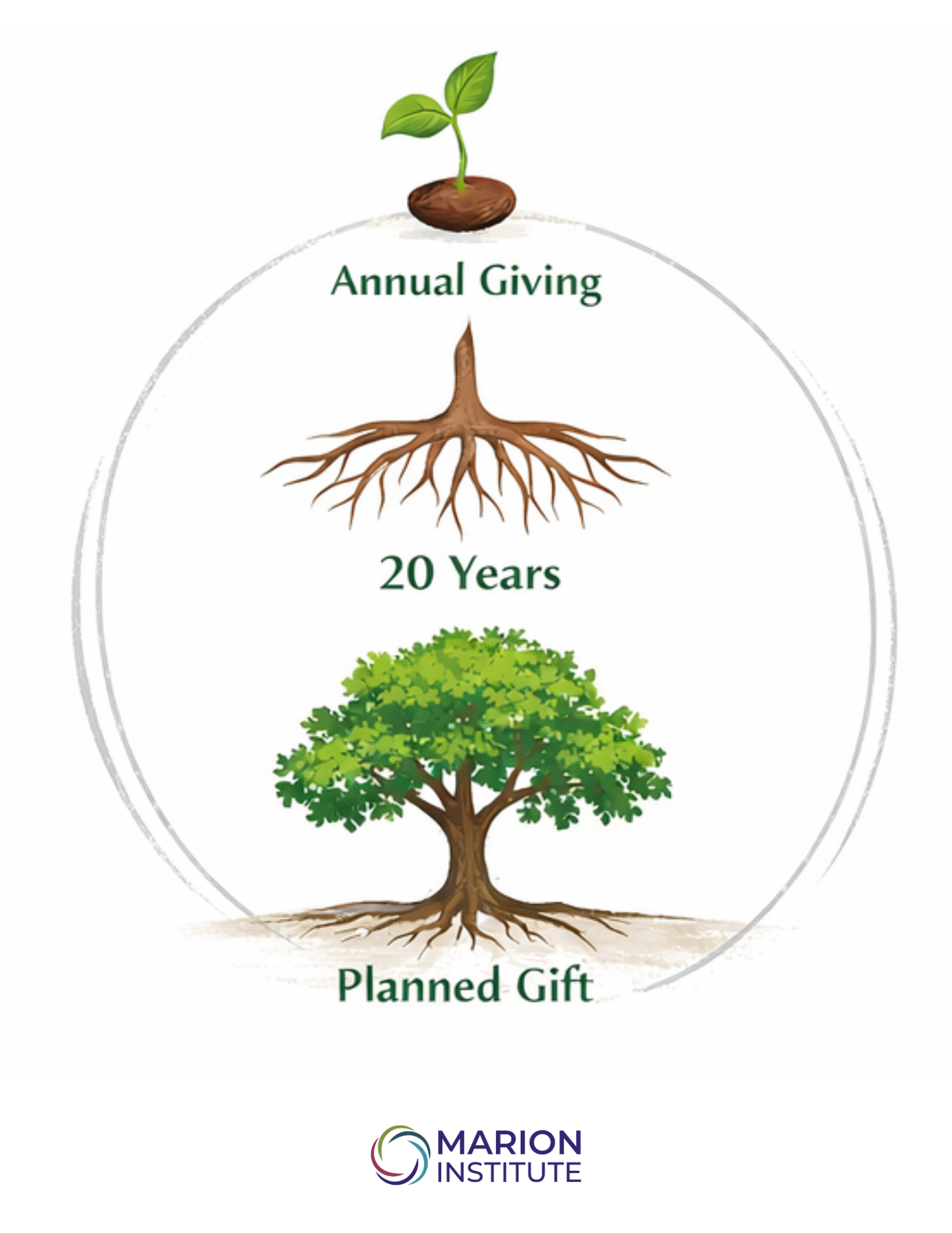

Through thoughtful estate planning, you can ensure the annual gift you make today continues to support our work for generations — using a guideline known as the Rule of 20.

Here’s how it works:

Take the amount of your annual donation and multiply it by 20. A planned gift in that amount to the Marion Institute’s endowment allows your annual gift to continue — permanently.

Why 20? Each year, up to 5% of the endowment’s value is distributed to support the Marion Institute’s operating budget. This means an endowed gift can generate reliable, ongoing support while preserving the principal over time.

For example, if you give $100 each year, a planned gift of $2,000 ($100 × 20) to the endowment can sustain that same $100 annual impact — in perpetuity.

Planned gifts can be made in a variety of ways, including:

-

A bequest in your will

-

A distribution from a trust

-

A designation from an IRA or retirement account

-

Proceeds from a life insurance policy

Each year, your planned gift would continue to generate support for the Marion Institute — carrying forward the generosity and values that matter most to you.

We invite you to consider reinforcing your commitment through a planned gift using the Rule of 20, and to become a member of the Marion Institute Legacy Society. Together, we can ensure that what you nurture today continues to grow well into the future.

Learn More:

If you are interested in learning more about the Marion Institute’s Legacy Society, as well as the financial and tax benefits of a planned gift (regardless of gift size), we are happy to share information and resources with you.

To execute your planned gift, please use our IRS-registered name, “The Marion Institute, Inc.” and EIN number 04-3206583.

As part of your estate plan, you can support the Marion Institute through a bequest, donor-advised fund, retirement fund, life insurance policy, or charitable trust. Your generosity helps us create healthy communities for all.

With any questions regarding the Legacy Society, contact:

Christy Mach Dubé

cmachdube@marioninstitute.org

508-748-0816 x118