Pricing with Purpose

What if investing in that $15,000 device on your wishlist could outperform the stock market?

By Bill Hershey | Non-CPA Accountant, Business Coach

Life Stream Business

Running an integrative health clinic doesn’t just require clinical expertise—it demands strategic thinking. And when it comes to major equipment purchases, that means seeing them not just as tools, but as capital investments. When investing in a large piece of equipment, there are many considerations to bear in mind (we covered a bunch of them in a blog from earlier this year: “Should I Buy That Expensive Equipment?”), and today we’ll be discussing the financial considerations.

Too often, I see clinic owners make business investments on a gut feeling or a hopeful hunch, without a clear plan for how they’ll pull it off. That’s where things can get a little risky. Without a financial forecast that incorporates all the various factors that will affect your cash flow, it becomes a nebulous guessing game. The forecast enables a business owner and their financial team to map out all the details. These economic factors include associated marketing costs, labor costs (which encompass both training and service delivery), interest associated with financing, and several other considerations, depending on the type of equipment.

You wouldn’t recommend a treatment plan without a diagnosis—so why make a significant financial move without a forecast?

To create an effective forecast, a business owner must first be able to access their financial data in the form of a profit and loss statement. Future cash flow can be predicted based on previously established patterns from a month-to-month view. And what needs to become clear through an effective forecast is how much you need to sell with this equipment for your business to generate a reasonable profit within a reasonable timeframe?

If your business is currently running at a 10% net profit, an investment like this should help your business grow, enabling you to sustain at least 10% net profit as you expand. In other words, you don’t want your business to become less efficient by investing in this equipment – it should help you grow sustainably without cutting into your profits.

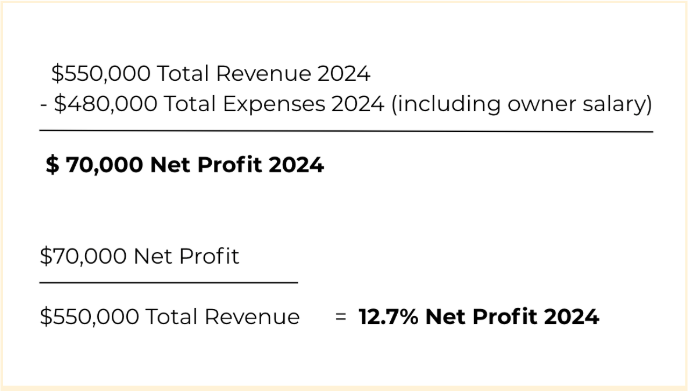

To determine your Net Profit %, take your total revenue for a given period (perhaps over the last 12 months) and subtract all your expenses from that period from the total. That’s your “Net Profit”. Then divide that figure by your total revenue, and that gives you your net profit %.

For example:

I’m a big fan of Greg Crabtree’s book, “Simple Numbers, Straight Talk, Big Profits” (he’s a CPA who spent his career helping small, local businesses in his community, which is quite different from big-time corporate accounting). Granted, it’s not all about generating profit when running a clinic, but profitability is what allows your business to be sustainable. And Greg’s general definition of a “healthy business” is earning at least 10% in Net Profit (while paying the owner a reasonable market-based salary), as that’s what allows a business to pay off debt and build cash reserves effectively. There are many nuances to this, of course, but that’s the basic principle.

In Greg’s second book, “Simple Numbers 2.0,” he discusses the criterion for making effective investment decisions in one’s business by breaking down another important metric called “Return on Invested Capital” (or ROIC). The key takeaway from this book is that strategic business investments should aim for a 50%–200% Return on Invested Capital (ROIC) within a 12–24 month period. Compare that to the stock market’s projected ~7% annual return, and you might realize the best investment available is the one you’re building every day (provided you’re working off a solid strategy and executing well). Granted, there aren’t any guarantees with any investment, and running a business comes with its own set of risks.

I’ll briefly break down what this “return on invested capital” means by continuing with the clinic example above.

Let’s say that’s my clinic, and I’m running at a total revenue of $550,000 and a net profit of $70,000. I then decide to invest $80,000 in a piece of equipment, and I forecast that I’ll spend an additional $20,000 on marketing and labor costs over the next year to launch this new service in my clinic successfully. That’s a total investment of $100,000.

Greg Crabtree refers to this type of investment as a “catalytic spend.” It’s money spent above and beyond your everyday operations. That means your ROI calculation should factor in everything: the cost of the equipment, the additional labor, the marketing push, and so on.I should therefore aim to generate revenue (i.e., sales or income) in such a way that (after expenses, owner pay, and taxes) I can see an increase in my net profit by 50%-200% of that invested amount in net profits within a 1-2 year period. That original invested amount (i.e., the “catalytic spend) was $100,000. Therefore, we aim to increase the net profit by at least $50,000.

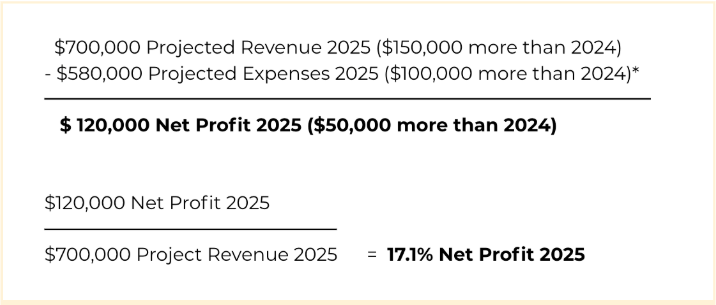

If we simplify the entire scenario for the sake of this example, this might be the new projected scenario at the end of 2025 (bear in mind I’m simplifying this for the sake of teaching the principle):

*Large equipment costs should be recorded as an asset rather than an expense, but for the sake of simplifying this example, I’m calling it an expense.

If the growth projections in the above scenario are based on realistic assumptions and the financial goals are reasonably attainable, we could therefore assess that this investment decision would be great for the business. Why? Because it fits two key criteria for financial decision making:

- This investment would enable the business to increase its net profit percentage from 12.7% to 17.1%, making the company more efficient, which could allow it to invest in even more valuable services for its patients or bring in other top experts to the practice.

- This investment enables the business to achieve a 50% return on its invested capital within a 12-month period.

There is certainly a lot more involved when considering a significant equipment investment in one’s clinic, but this is at least a great start. How likely is it that your forecast will go perfectly according to plan? As we know, things rarely go perfectly according to plan. But as Napoleon Bonaparte once famously said:

“No plan survives the battlefield, but I never go onto the battlefield without a plan.”

My advice? Read Greg Crabtree’s books before purchasing your equipment, if possible. Ask your accountant to read them too, if they’re open to it. If they’re not, feel free to reach out to me, and I’d be happy to offer a complimentary 30-minute consultation to talk through some of the basics with you (depending on my availability at that time, of course).

Once you have an understanding of the key principles of that book (or at least your accountant does), make sure that you and your financial team can lay out a reasonable forecast that shows what needs to happen with your monthly financial picture to allow for that kind of performance.

Don’t know how to forecast? No shame in that – I wouldn’t expect a clinician to know how to do that. That’s why working with a financial consultant or accountant can be a game-changer. They’ll help you crunch the numbers, factor in the hidden costs, and transform your vision into a viable strategy.

Ultimately, it’s not all about business and money. It’s about fulfilling the deeper purpose of your work and the reasons you started your clinic in the first place. Any purpose worth achieving has a financial requirement, and having sufficient resources opens up options for accomplishing your purpose through even more wonderful ways.

If you’d like more information on growth strategies for Integrative Health Clinics, feel free to check out my website or reach out for more info:

Website: www.lifestreambusiness.com (the quiz is a great place to start)

Email: info@lifestreambusiness.com

Hi, I’m Bill 🌿

I founded Life Stream Business Services to provide strategy, coaching, accounting and bookkeeping services for integrative health practitioners who want to organize their finances and proactively grow their business, without sacrificing their values (or going broke).

I practice, study, and write about business growth and personal growth, thereby helping many of my clients grow past what they thought was possible in their business.

My work with clients applies methods of strategic business development, Somatic Experiencing, Integral Coaching, financial advisory and customized business growth models specifically geared toward Integrative Health clinics and solo-practices.

- Vision-expansive

- Trauma-informed

- Emotionally-attuned

- Financially-literate

- Dharma-inclined